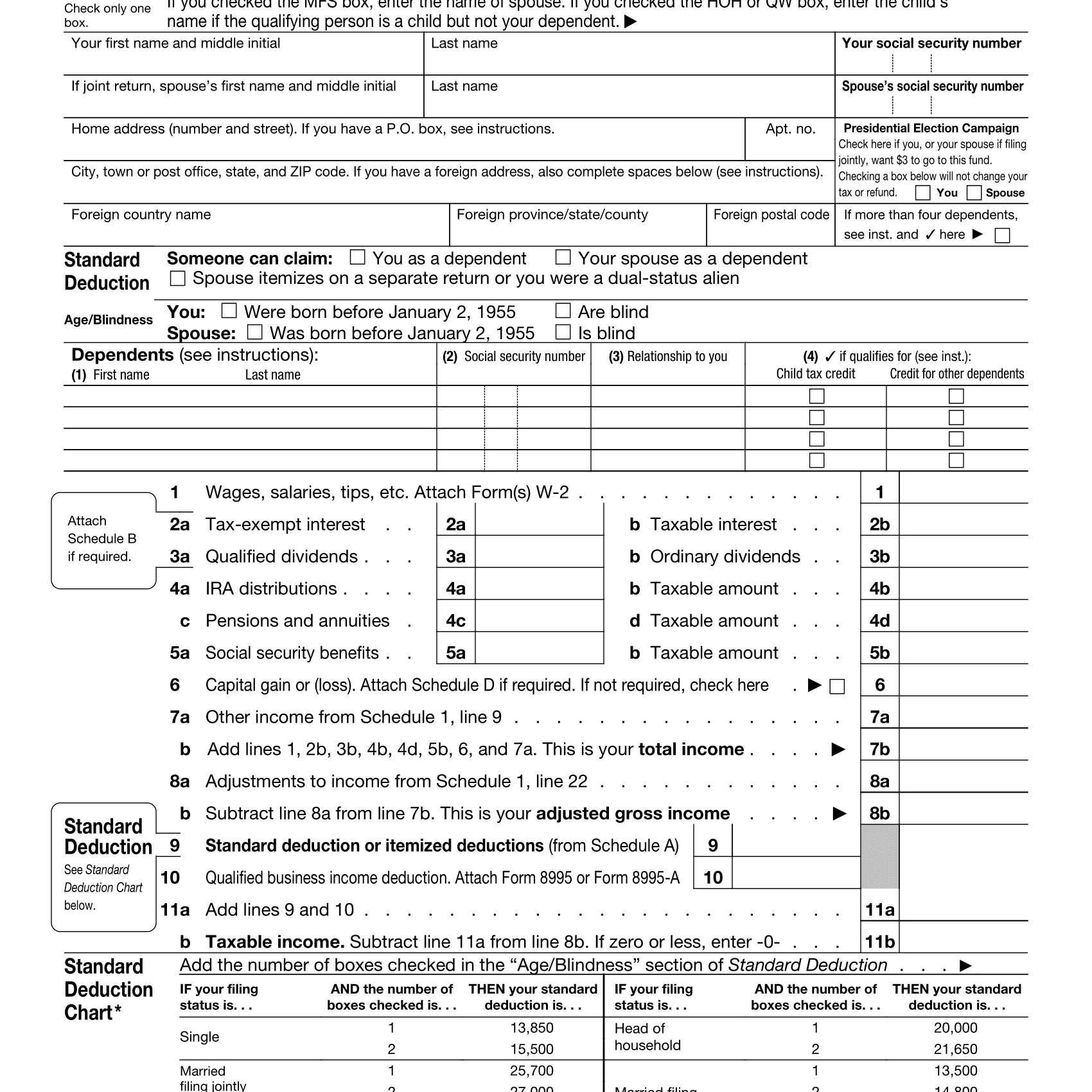

2025 Standard Deduction Single Senior - 2025 Tax Rates And Deductions For Seniors Debi Charleen, — the standard deduction for those over age 65 in tax year 2025 (filing in 2025) is $15,700 for singles, $29,200 for married filing jointly if only one partner is over 65 (or. If you earned $75,000 in 2025 and file as a single taxpayer, taking the standard deduction of $13,850 will reduce your taxable income to $61,150. Section 194p of the income tax act, 1961 provides conditions for exempting senior citizens from filing income tax returns aged 75 years.

2025 Tax Rates And Deductions For Seniors Debi Charleen, — the standard deduction for those over age 65 in tax year 2025 (filing in 2025) is $15,700 for singles, $29,200 for married filing jointly if only one partner is over 65 (or.

2025 Standard Deduction Single Over Age 65 Dulcia Robbie, — the basic standard deduction in 2025 and my estimate for 2025 are:

.jpg?width=8333&name=tax graphic_2020 (1).jpg)

Irs 2025 Standard Deduction For Seniors Brier Carissa, How much is the standard deduction for 2025?

2025 Standard Deduction Single Senior. — the standard deduction for those over age 65 in tax year 2025 (filing in 2025) is $15,700 for singles, $29,200 for married filing jointly if only one partner is over 65 (or. (returns normally filed in 2025) standard deduction amounts increased between $750 and $1,500 from 2025.

Irs 2025 Standard Deduction For Seniors Cissy Corrianne, — for 2025, the federal standard deduction for single filers was $13,850, for married filing jointly it was $27,700 and for the head of household filers, it increased to.

Standard Deduction 2025 For Seniors Over 65 Eba Kristy, — the standard deduction for those over age 65 in tax year 2025 (filing in 2025) is $15,700 for singles, $29,200 for married filing jointly if only one partner is over 65 (or.

Standard Deduction 2025 Irs Cody Mercie, — under the project 2025 proposal, you could pay more or less in federal income taxes, depending on your current bracket, according to howard gleckman,.

What Is The 2025 Federal Standard Deduction For Seniors Nomi Tallou, Section 194p of the income tax act, 1961 provides conditions for exempting senior citizens from filing income tax returns aged 75 years.

2025 Standard Deduction For Seniors Over 65 Eimile Libbie, — if you are 65 or older and blind, the extra standard deduction for 2025 is $3,900 if you are single or filing as head of household.

Standard Tax Deduction 2025 For Seniors Tori Aindrea, (returns normally filed in 2025) standard deduction amounts increased between $750 and $1,500 from 2025.

Tax Year 2025 Standard Deduction For Seniors Arda, How much is the standard deduction for 2025?