Income Tax Rates 2025/24 Uk Images References : - Tax Rates 2025/2025 Uk Frank Jillene, The higher rate applies to taxable income between £50,271 and £125,140, and the additional rate applies to taxable income over £125,140. Tax Calculator 2025 2025 Uk Dodie Freddie, See all the main tax thresholds and allowances for income tax, capital gains tax and more.

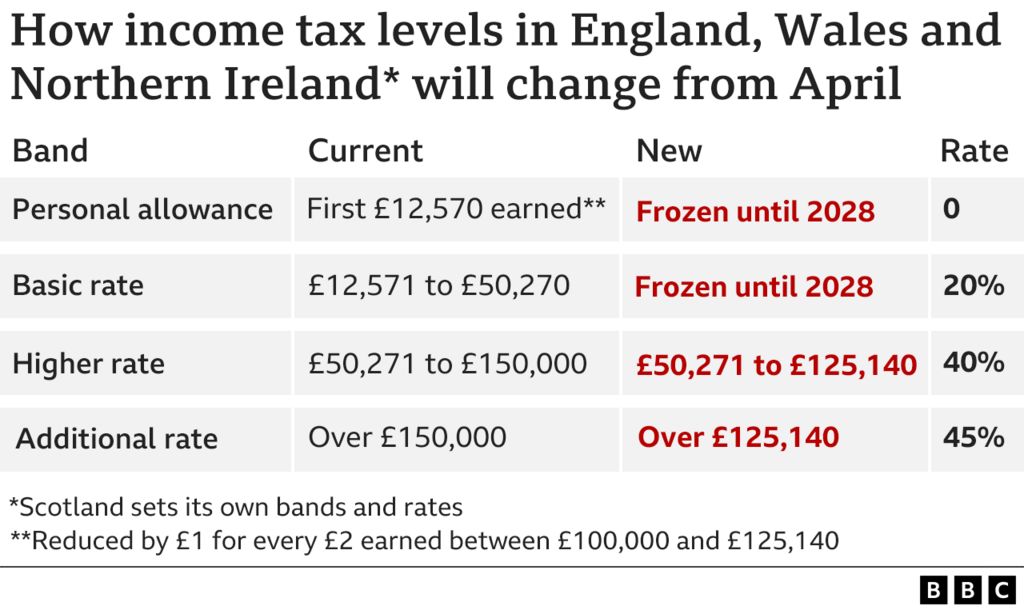

Tax Rates 2025/2025 Uk Frank Jillene, The higher rate applies to taxable income between £50,271 and £125,140, and the additional rate applies to taxable income over £125,140.

Tax Rates 2025 24 Uk Image to u, 2025/2025 tax rates and allowances.

Income Tax Rates 2025/24 Uk. 20% tax on earnings between £12,571 and £50,270; — the 2025/24 income tax rates for britain are:

Uk Tax Rates 2025 Magda Jobina, From 2017 to 2018, the main rates were separated into the.

Tax rates for the 2025 year of assessment Just One Lap, This article breaks down the ins and outs of the new tax year for individuals and businesses, including the key changes, so you can feel confident stepping into the new financial year.

Autumn Statement 2022 HMRC tax rates and allowances for 2025/24, You can turn on/off different years and options by clicking on the legend below the chart.

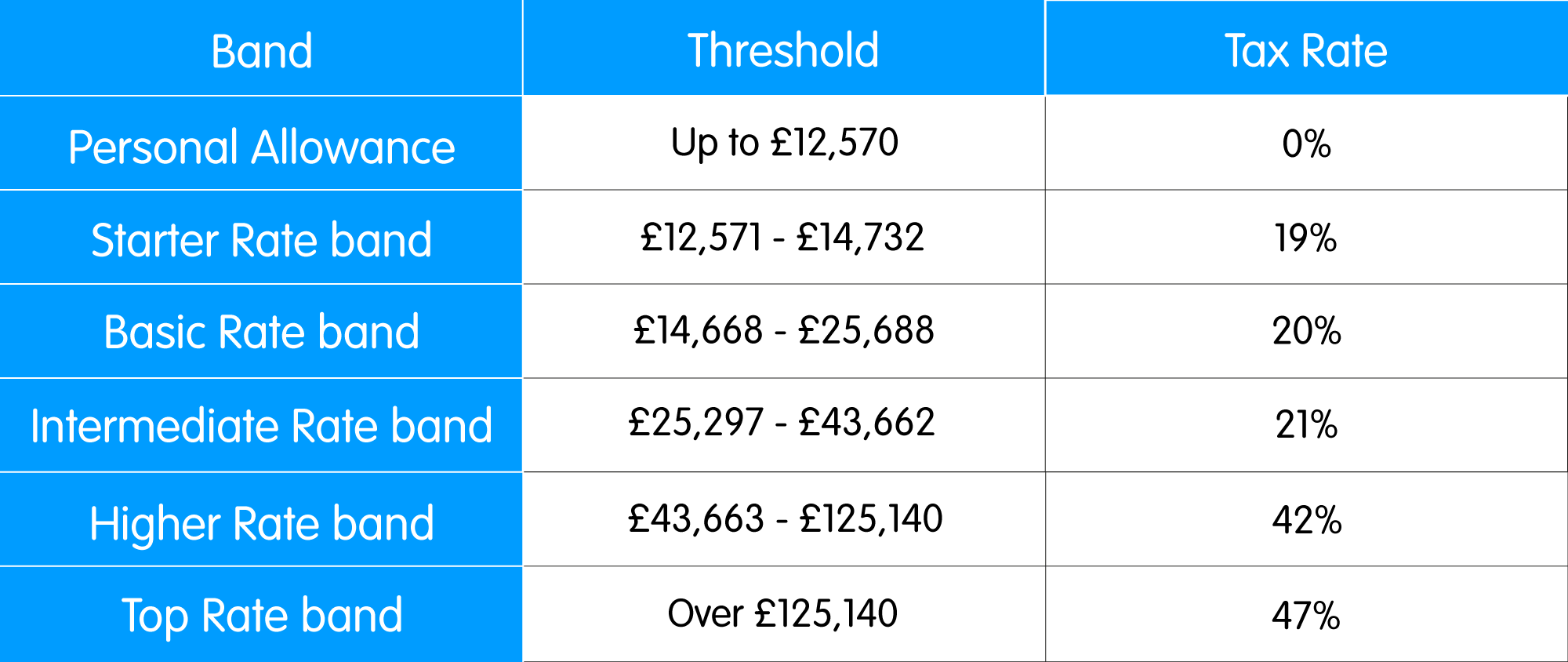

Tax Rates For Assessment Year 2025 25 Image to u, The standard personal allowance for the 2025/25 tax year is £12,570.

Changes To Tax Rates 2025 Molly Therese, The standard personal allowance for the 2025/25 tax year is £12,570.

Tax Rates 2025 25 Image to u, — there will be some new national insurance rates and thresholds from 6 april 2025.

The tax tables below include the tax rates, thresholds and allowances included in the england tax calculator 2025. The income tax and personal allowances are used to calculate the amount of income tax due in the 2025 to 2025 tax year, if you are an employee, your income tax will typically be calculated and deducted from your salary as pay as you earn (paye) along with your other salary deductions like national insurance, company pension and student loans.

Uk Tax Rates 2025/24 Gael Pattie, — the income tax rates for the 2025 tax year are as follows: